UPI: tap into the fastest growing payment method in India

Saying that Indian e-commerce is a fast-growing market is not news. More and more foreign merchants are expanding on this fast-growing market. Most of these merchants have barely touched the surface of their revenue potential in the Indian market because they haven’t figured out the right payment mix.

Currently, only 23% of eCommerce transactions in India are paid with international credit cards. Alternative payment methods like digital wallets, cash or bank transfer claim a big portion of the eCommerce payment pie. In addition to the share that the payment method holds, merchants should pay attention to the growth speed that each method is showing.

This is why UPI, with its whooping 25x growth year over year, is generating so much interest among merchants expanding to India. And that’s not it. Take a look at these numbers:

- In April 2018, UPI handled 190 million in transactions. 6 months later, in October 2018, that figure rose to 482 million monthly transactions.

- The transaction amount was 3.8 billion 6 months ago. By October, the same amount was already 10.7 billion.

What is UPI?

UPI is an instant real-time payment system facilitating inter-bank transactions, developed by the NCPI, an umbrella organization for operating retail payments and settlement systems in India.

The Unified Payment Interface (UPI) can be thought of like “an email ID for the money”. A unique identifier that the bank uses to transfer money to merchants or other banks, in real-time. It uses a Virtual Payment Address – e.g. john@icicibank – as a unique ID for identifying its users and perform payments.

With a banked population of 53%, the number of bank accounts in India is much larger than the number of wallet users. While the penetration of Paytm and other wallets might seem high, the number of bank accounts in India is much higher than the number of wallet users. In addition, the Indian government has prohibited the use of wallets for any cross-border transactions because of lax KYC requirements, so essentially, they are irrelevant for merchants who don’t have their own on the ground operations in the country. By allowing for UPI, the expectation is that those who do not have wallets but have a bank account and want to start doing e-commerce transactions can get into the mainstream.

UPI genuinely started democratizing digital payments in India, and the best part is that it is present from the day you have a bank account.

Why are end-users adopting UPI?

- Always available: UPI is a 24/7/365 Service

- Easy to use: no need to type payment or account details – just accept the payment request already displayed on the screen.

- The user holds all their bank accounts under one hood

- Safe and secure: no need to share credentials – just use the virtual ID (VPA). It is more difficult for criminals to gain access, as the interface uses a Double factor Authenticator (2FA)

- UPI delivers a 100% mobile-first experience: NCIC specifically conceived it to be used on mobile devices. It’s an App-based service, and users can either pay using the generic BHIM App (developed by the NCIC) or through their own bank App.

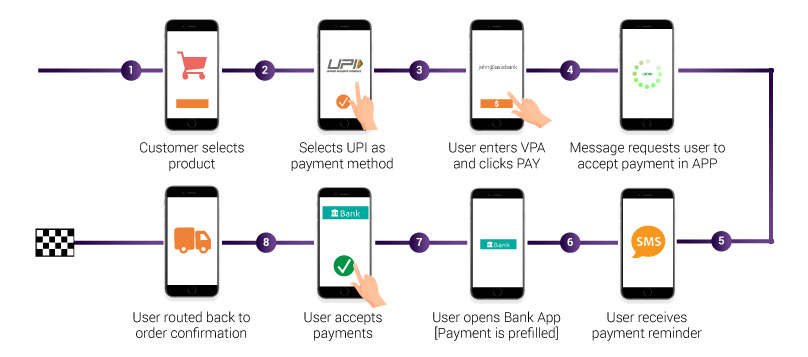

Customer experience flow

UPI vs. netbanking

You may also have heard about Netbanking in India. So, what’s the difference between them? Although both methods rely on a bank transfer as a mechanism because UPI was designed as a mobile-first solution it is much more user-friendly for mobile users:

- It integrates with the all the banking apps

- It is more convenient to operate with an email-like ID (i.e. john@icicibank) instead of an account number (as in Netbanking)

- It prefills all the needed payment information