Boleto Bancario – Brazil’s most popular cash payment method

Purchasing goods and services online while paying with cash sounds like an oxymoron to many of us in the US and Western Europe. Yet, using offline payment methods to pay for online purchases is not that uncommon in LATAM – in fact, it’s quite popular.

Brazil’s central bank estimates nearly 55 million Brazilians don’t have a bank account, underlining the need to provide alternative payment methods. But don’t be fooled by the number of unbanked consumers in the country. Around 60% of the population still shop online and 44% also transact cross-border. 52% of digital buyers complete their transaction using Brazil’s most popular cash payment method, Boleto Bancario.

Boleto Bancario - what is it and how it is used?

The word Boleto literally means a ‘ticket’. This payment method is regulated by the Brazilian Federation of Banks and is used for utility payments, rent and now eCommerce.

It is a push-payment, which relies on the consumer initialize the payment action. The process is similar to the process of paying with a bank wire. At the core of it is an invoice-like form or ticket that’s issued to the end-user to complete their payment for goods or services. The Boleto ticket always specifies the amount and the due date by which the payment must be completed. There are thousands of locations throughout Brazil where a Boleto can be paid: ATMs, branch facilities and internet banking of any Bank, Post Office, Lottery Agent, and some supermarkets.

In Brazil, where ⅔ of its 200 million population doesn’t have a credit card, Boleto is ubiquitous, generating 50 million transactions a month. For the 55 million unbanked, it is the only way to buy goods and services online. But it is not just the unbanked who use this payment method. When it comes to online purchases, Boleto is especially popular for high-ticket items because many consumers are still insecure about providing their card information online. Local and regional merchants often offer discounts for Boleto payments because there is no chargeback risk and the payment is made upfront.

Boleto - beyond cash payments

When Boleto was originally introduced in 1993, it was designed to work solely with cash. Over the past few years, this payment method has evolved to work with bank transfers, both online and offline. In fact, Brazil is quite advanced in the use of online and mobile banking — 55% of all bank transactions come from mobile and internet banking. What’s even more astounding is that about 30% of Boleto Bancario transactions originate on a mobile device, a share that is only bound to grow.

This makes the Boleto a great payment mechanism to add to Brazil’s local payment mix.

Mobile Boleto for phones and tablets

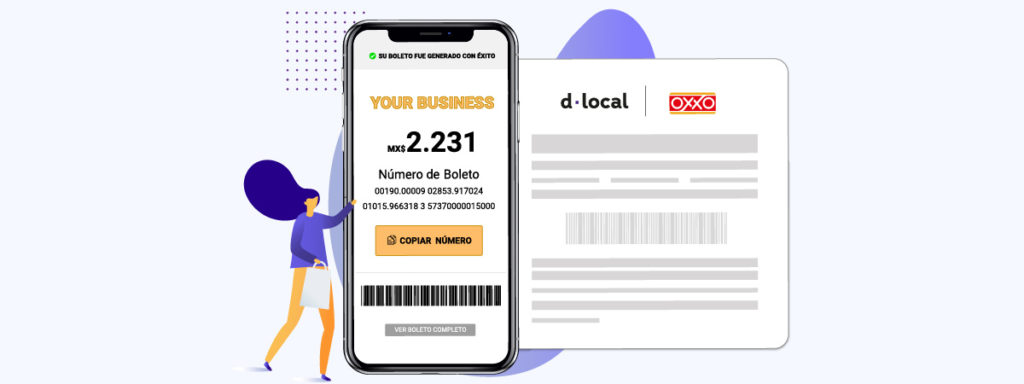

At dLocal, we’ve done a number of enhancements to simplify the experience of paying with Boleto, especially for mobile users who know how to use internet banking. Our solution takes these users from initiating a Boleto payment through payment completion in a few easy steps, allowing them to complete their payment is just a few seconds. The user doesn’t need to copy and paste any barcodes or numeric codes associated with their Boleto ticket – our solution automatically injects all the relevant information into the user’s internet banking application so they can complete the payment in a just a couple of clicks.

User purchases product/service and…

…is redirected to generated Boleto voucher

User pays in closest Boleto location…

…or pays through online banking

Merchant is notified within minutes

Customizing the UI of your Boleto user experience

We know how important it is to keep the user experience clean and smooth throughout the checkout process so users could finish their payments quickly without awakening any anxieties that they may have about the purchase or payment. Alternative payment methods inherently introduce friction into the checkout and payment process. At dLocal, we are offering merchants the ability to customize the look and feel of various APM. This means merchants can infuse the UI of Boletos with their own branding to make the whole payment experience cohesive end-to-end.

Payment confirmation with Boleto

Boleto payments are typically confirmed with a delay of 2-3 business days. We’ve managed to shrink that window to just a few minutes, making the payment confirmation practically instant. This enables merchants to release the goods and services almost immediately after the transaction has been completed, instead of keeping the inventory on hold for a few days (which is common for other AMPs). Our FastBoleto is automatically available to any merchant who is integrated with us using our Payins API.

While Boleto is an important payment method in Brazil, there is much more to consider when formulating your local payment strategy. Learn more about the payment methods we support in Brazil or download our Brazil country guide to better understand the payment landscape in this exciting market.