Direct APM in Latin America – A must Have in your Payments Strategy

Consumer’s culture matters, in Latin America and in any other emerging market. Cash payment methods like Boleto Bancario in Brazil and Oxxo in Mexico or bank transfers in Colombia, and Chile have become as predominant as needed. Enabling alternative payment methods helps to unlock the payment frictions within these markets.

Direct Alternative Payment Methods (APMs) allow merchants to build their own voucher user interface without redirecting their customers to any third-party payment page. Merchants receive the payment parameters needed to create the payment voucher through an API response. Let’s take Argentina as an example. We explain what Argentinian’s direct APM Pago Fácil looks like and how it works.

Pago Fácil - what is it and how it is used?

Pago Fácil, together with Rapipago, are the most popular chains of extra-banking physical payment locations in Argentina. They are usually used by Argentinians to pay for utility bills, such as electricity, gas, cable TV, internet and other common living expenses. Together, Rapipago and Pago Fácil have more than 11,000 locations where users can pay for these daily services. These are also places where they can pay for their e-commerce bills.

The customer selects Pago Fácil as its preferred payment method, and is redirected to a new generated voucher. Once the customer has its voucher, they need to go pay it cash to the closest Pago Fácil retail location. When doing so, the payment will be marked as “completed” and the merchant gets notified of the successful payment immediately.

Download our Whitepaper about Cash Payments in Argentina here.

The customer selects Pago Fácil as its preferred payment method, and is redirected to a new generated voucher. Once the customer has its voucher, they need to go pay it cash to the closest Pago Fácil retail location. When doing so, the payment will be marked as “completed” and the merchant gets notified of the successful payment immediately.

Download our Whitepaper about Cash Payments in Argentina here.

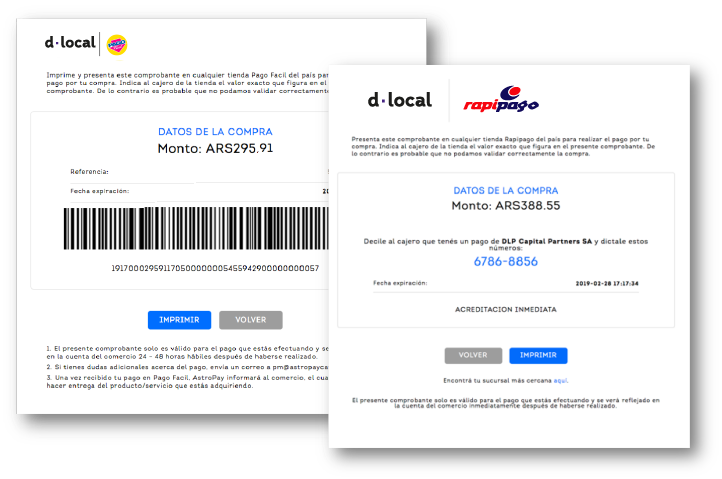

Customizable UI - build your own Pago Fácil voucher

As you can see in the example voucher below, the Pago Fácil voucher only displays essential information for the end user such as amount and due date. dLocal’s Pago Fácil voucher is built responsive, allowing the customer to have an optimized user experience when trying to purchase a product or service through a mobile device.

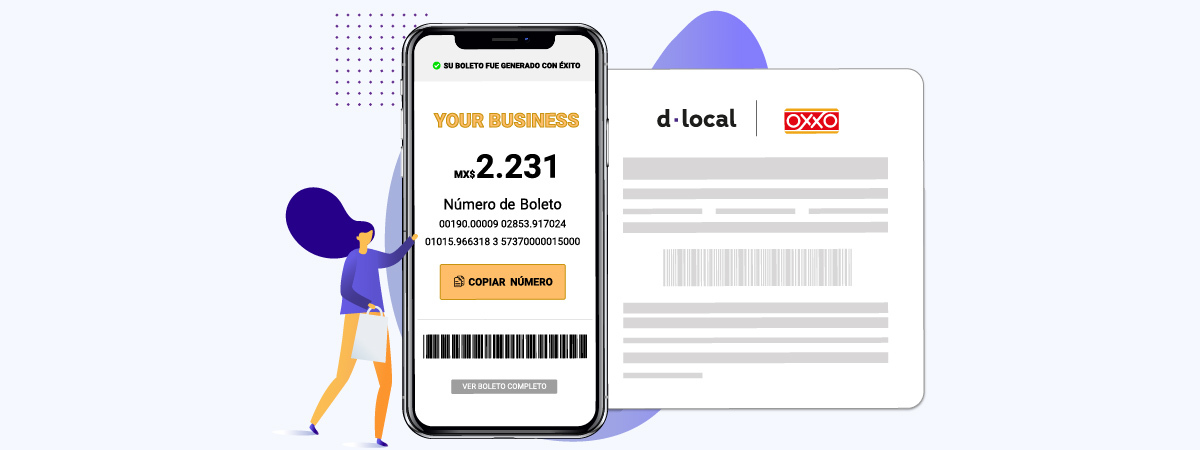

Extra Candy: Personalized Direct APM feature

And the best part- thanks to our Direct APMs feature, you’ll be able to build your own Pago Fácil UI, matching your business or website’s look and feel. By receiving the parameters in the API response, and building the voucher inside your own website, your user won’t need to leave your website through a redirect. In simple words: once the user selects Pago Fácil as the payment method, your own Pago Fácil voucher, matching your look and feel, will be generated and displayed. The user will take the number on the screen to the closest Pago Fácil location, ask the cashier to process the payment, and pay with cash.

Pago Fácil, as well as other Direct APMs, are already available for cash methods in the three major markets in LATAM: Brazil (Boleto Bancario), Argentina, and Mexico (Oxxo).

While Pago Fácil is an important payment method in Argentina, there is much more to consider when formulating your local payments strategy. Learn more about the payment methods we support in Argentina or download our Argentina country guide to better understand the payment landscape in this market.