ATPS Recap: Three Ways Voice is Revolutionizing Payments in Global Travel

Adoption rates for voice-enabled digital assistants, such as Amazon’s Alexa or Apple’s Siri apps, have grown considerably over the past five years. However, reservations remain when it comes to using intelligent voice-recognition capabilities to make or process payments. dLocal Vice President of Product Rodrigo Sanches, speaking at Ai’s 13th Annual Airline & Travel Payments Summit (ATPS) conference in London, noted that these concerns shouldn’t necessarily stop companies from leveraging these tools in the future, particularly as e-wallets gain in popularity in Asia and across the globe.

The word Boleto literally means a ‘ticket’. This payment methods is regulated by the Brazilian Federation of Banks and is used for utility payments, rent and now e-commerce.

Ai has been organizing commercial aviation conferences since 2005, hosting thousands of airline and travel professionals at the company’s conferences, forums, and other events. The theme for Ai’s latest travel-payments focused conference was “Engage, Experience and Execute,” where speakers delved into how payments and fraud prevention schemes will work for customers in the day-to-day reality of the Internet World.

Rodrigo Sanches, while acknowledging the security concerns specific to payments in a voice-activated world, noted that these worries should not stand in the way of companies from developing their strategy around voice payments. He cited three main areas along a company’s sales funnel — Search, Authentication, and Payment – that leaders in the travel and aviation space will want to keep in mind.

Searching:

How consumers use voice to search for flights, hotels, or anything, really, is evolving every day. In order for companies to best optimize their search experience, they should try to remove as much friction as possible. This means contextualizing demands from the user, removing background noise coming from irrelevant data, and deploying machine learning and Al to continually refine the experience. Taking small steps, like learning from the results of power- users, can help companies in the long run.

Authentication:

Security is the No. 1 concern for voice payments. This is why it is so critical that once a user had chosen their flight or travel accommodations, the company can authenticate the purchase or reservation in order to prevent fraud.

Voice-recognition technology has two main tracks: Biometrics and Multiple-Factor Authentication (MFAs). Although biometric voice recognition can distinguish characteristics like accent and nasal passage, it’s still not enough. Using MFAs are the most secure option for authentication. It’s about using something customers know (such as a password or secure code), something they have (device), as well as something that helps identify who they are (voice). Many companies, when possible, will try to leverage existing networks from appropriate partners (such as logging in through Google or other services.)

Payments:

What are the best options to pay with your voice? This is the question we hear more than any other when it comes to voice-enabled capabilities. And the natural follow-up is what opportunities exist in the near future for emerging markets?

In order for companies to optimize their payment capabilities the key is that they allow for an easy payment process. For many consumers, this means paying with cards and digital wallets in order to reduce friction at checkout. Companies will also want to facilitate payment methods that are already enabled for existing users as well as allow for saved cards on their payments platform. When discussing worldwide expansion, however, it’s beholden on companies to allow for local payment methods and wallets, which will pioneer adoption in each region. The nuance that exists between markets can be challenging for companies with global aspirations, but payment service providers can streamline the learning curve and offer seamless access to growing geographies..

E-wallets grab market share

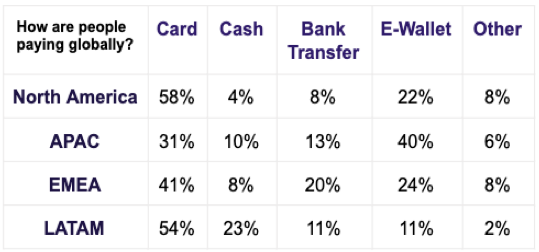

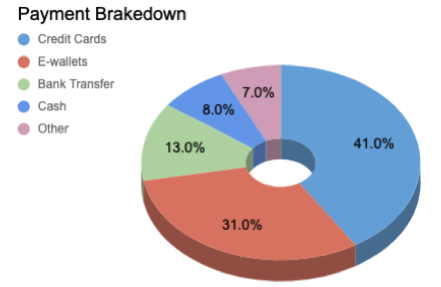

While international and local credit cards seem ubiquitous across North America and Latin America, across the globe only 41% of people use credit cards as their prevailing form of payment. Though cards are used by nearly 60% of people in the North American region, they are much less popular in other places. In fact, less than a third (or 31%) of the Asia-Pacific population are regular users of credit cards.

E-Wallets, on the other hand, have carved out a big role in the payments landscape. Today e-wallets are used by 31% of the population worldwide and are extremely popular in Asia, where two out of every five consumers prefer this form of payment.

Targeting the top spenders in travel

Of the total volume of global e-commerce, 16% is spent within the Travel industry. So, who are the top spenders in Travel?

Of the total volume of global e-commerce, 16% is spent within the Travel industry. So, who are the top spenders in Travel?

Saudi Arabia is the No. 1 spender, with 34% of the country’s total e-commerce volume dedicated to travel purchases. Other emerging markets, like Colombia and Chile, spend an average of 31% of their total e-commerce volume on travel. Notably, this is more than New Zealand, Switzerland, Norway and Canada.

Staying ahead of Travel Fraud

Given how much money is dedicated to the travel industry, it’s not surprising that bad actors have gravitated to the space. Total fraud losses to travel intermediaries are expected to grow 19% to $25 Billion by 2020. Today, organized fraud rings are themselves advancing their technology and even using automation to target unwitting consumers anywhere at any time. The “Dark Web” today is rife with stolen customer data available for purchase, making it that much easier to commit fraud today than in previous eras. Loyalty programs are also increasingly becoming a target of fraud, making it harder for end-users to complete a purchase safely.

When looking for ways to try to prevent fraud, companies should always try to find ways to identify bad actors early in the process. This can help to reduce losses, while customers of good standing are diverted to approved channels to allow for operational efficiency.

In the next few years, voice payments will have a big challenge in becoming a true asset and not just “the latest gimmick” in commerce. The biggest opportunity among those who leverage these capabilities lies in the developing world, where adoption rates for digital assistants are quite high and where innovation in this area can open a window for new digital payment methods and open-banking solutions. The voice of the consumer can become their wallet when they just say: “Pay!”