Rock cash payments in Brazil

Accept cash payments in Brazil with Boleto Bancario and get notified of payment status within minutes.

Boleto Bancário is the most popular cash payment method in Brazil, that allows a shopper to pay for online services either over the counter at any supporting outlet in Brazil (more than 200.000 locations), or through internet banking. Millions of people who don’t have a bank account, choose this popular payment method when buying online.

With dLocal’s Boleto, you can get notified within minutes after the user pays. And it gets even better: with dLocal’s Direct APMs solution, you can Improve user experience by crafting your own customized Boleto UI. This improves payment conversions and allows you to deliver an experience that matches your brand’s look and feel.

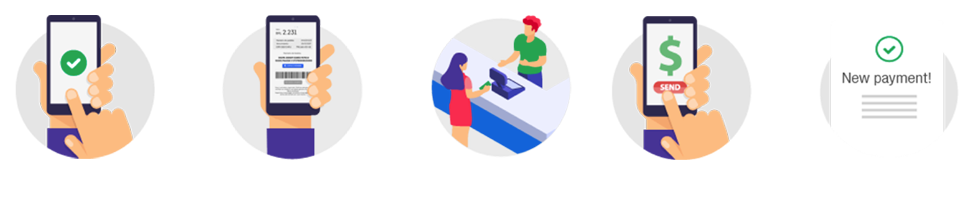

How does the user pay with boleto bancario?

Why use dlocal’s boleto?

Get more payment completions with optimized UI

► With Direct APMs you can customize your own Boleto. i.e.: showing only de main info:

► Your company logo

► Order number

► User’s CPF (Brazil’s National ID)

► Manages inputs for all major banks in Brazil

► No printing needed! Barcode can be used in ATMs and local bank branches

See what dLocal can do for you

Ready to win in emerging markets? Want to test drive the payment platform that some of the most innovative companies trust to handle billions in transactions?