Mobile Money in Africa

Mobile money payment platforms are a natural for emerging markets. They’re a cashless, convenient way to buy goods and services, pay bills and make peer-to-peer transfers. And consumers don’t need to be tied to a financial institution to use them. In fact, anyone with a mobile phone on a supporting network is ready to start enjoying the benefits of mobile money to send and receive payments.

One could even argue that, apart from cash, mobile money is one of the most financially inclusive payment methods on the planet.

Nowhere is this more true than In Africa, where consumers tend to rely on cash and steer away from having bank or credit card accounts. Take Kenya, for example, where credit card penetration is only 6% and debit card penetration is 37.5%, while mobile money account penetration is a whopping 76%.

There are other indicators that mobile money offers huge opportunities for merchants wanting to enter the African market or expand operations there:

- Mobile money deployments in Sub-Saharan Africa are experiencing the most growth — increasing 39% each year.

- Kenya-based M-PESA is now the world’s largest mobile-money network.

- Africa still remains a largely untapped and high-growth market, so it’s a good time for merchants to stake their territory.

- The COVID-19 pandemic lockdowns have left many Africans looking for online, mobile-based alternatives, such as mobile money.

The popularity of mobile money in Africa

The bottom-line reason why mobile money is so popular in Africa is simply because it fits with the lifestyle of so many people. It goes along with dLocal’s philosophy that fintech has to meet consumers’ expectations of the payment methods they rely on. Here are some ways mobile money meets that need:

- Mobile money is accessible. Anyone with a mobile phone can have an account. Users don’t need a bank account.

- It’s multi-faceted. Users can perform all kinds of payments, such as receiving, storing, spending and sending money, all via their mobile money account.

- It’s direct. There is no middle man when people use mobile money. Transactions are made between just the customer and the merchant.

- It’s fast. Mobile money transactions occur instantly. No waiting periods to verify the funds are there, such as might happen if a bank is involved.

- It’s convenient. As long as users have a mobile network signal, they can use their mobile money account.

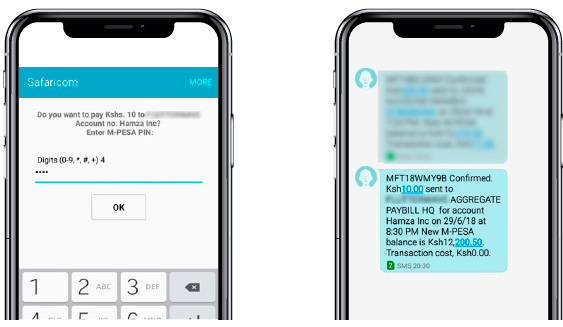

- It’s secure. Mobile money funds are protected by local financial regulations, and a PIN is required for every transaction.

- It’s low-cost. Most users can easily access mobile money from their service providers without the attendant fees that are sometimes associated with other payment methods like cards.

These attributes of mobile money and the circumstances brought about by the pandemic explain dLocal’s success in connecting thousands of online merchants to African consumers, and why we’re expanding our African footprint. Doubling it, in fact. We now cover 8 countries in North and Sub-Saharan Africa: Egypt, Morocco, Nigeria, South Africa, Kenya, Ghana, Senegal, and Cameroon.

How Mobile Money works for merchants and end users

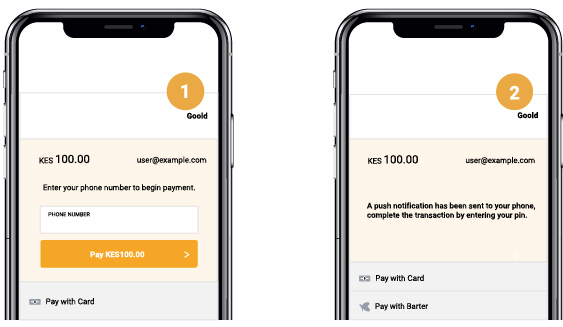

Paying with mobile money is as simple as sending an SMS, and transactions take only seconds.

1. During checkout, the user is required to input a phone number to pay for the service.

2. The user then receives a push notification, asking to confirm the payment with a mobile money PIN, after which both the user and merchant receive an SMS confirming the payment.

Going local is key to succeeding in emerging market e-commerce

Despite the “blue ocean” promise of the African mobile money market, it does pose challenges. Africa is a complex and heterogeneous region, and many Africans find themselves financially excluded.

That’s why knowing how to reach consumers who aren’t connected to a financial institution and are used to buying locally is key. Offering Africans mobile money platforms is a perfect solution to bridge that gap.